Kingston, Ontario–(Newsfile Corp. – July 4, 2024) – Delta Resources Limited (TSXV: DLTA) (OTC Pink: DTARF) (FSE: 6G01) (“Delta” or “The Company”) announces that, at the request of the TSX Venture Exchange regulators, it has amended the option agreement announced on May 23, 2024 with Golden Share Resources Corporation (“Golden Share“). The objective of the amendment is to fix the absolute maximum number of shares that could possibly be issued by Delta to Golden Share by fixing the minimum price per share that Delta would issue as part of the agreement. The minimum price of the Delta shares was therefore fixed at $0.075 for a maximum possible issuance of 9,333,333 shares that could be issued to Golden Share.

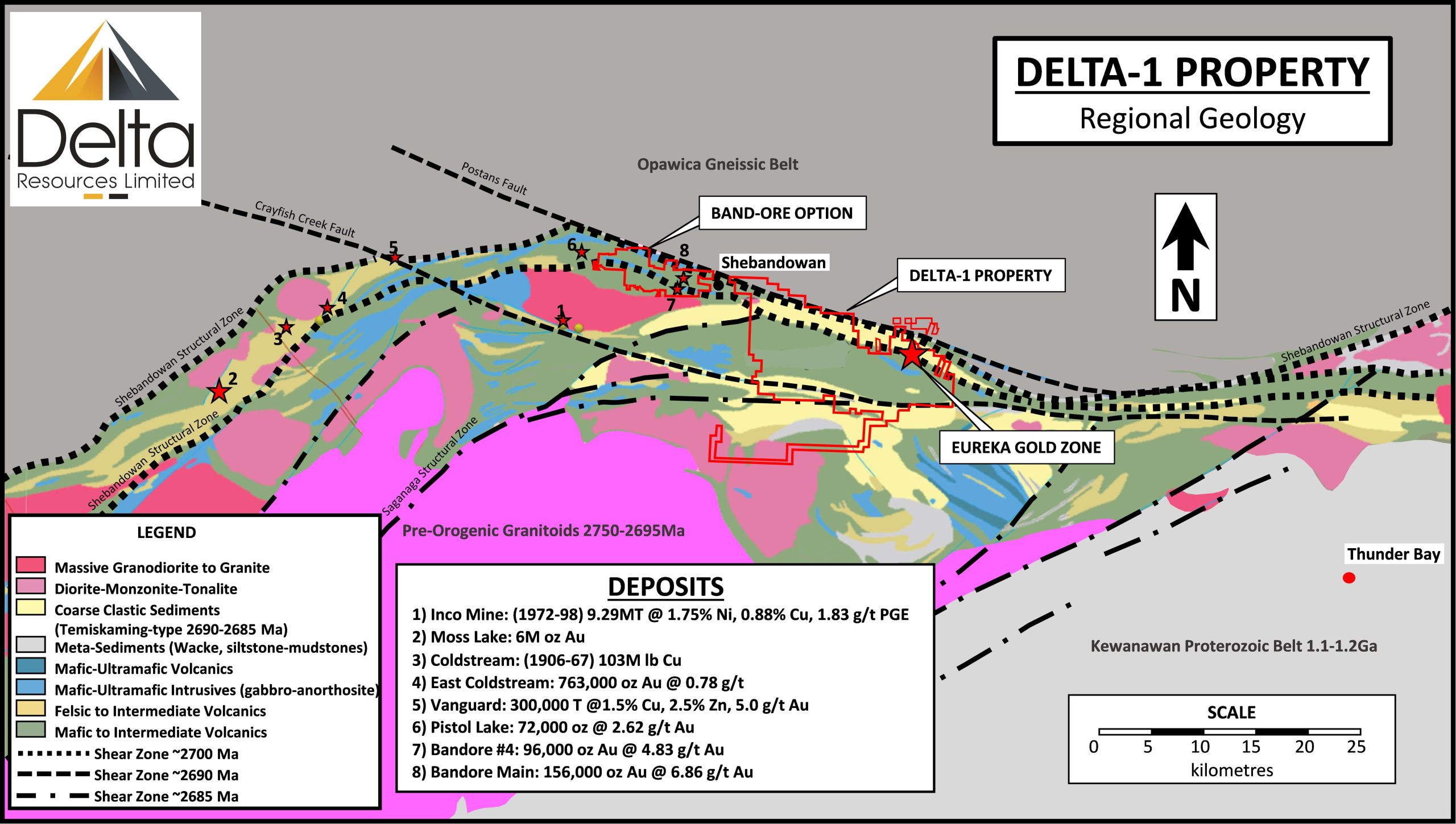

Figure 1: Geological map of the Shebandowan greenstone belt showing the location of the Band-Ore option relative to the Delta-1 Property.

On May 23, 2024, Delta announced that it was acquiring the exclusive rights to earn a 100% interest in the Band-Ore property (the “Property“). The Band-Ore property is located approximately two (2) kilometres west of the Delta-1 property which in turn lies 50 kilometres west of Thunder Bay, Ontario. The Property hosts two historic high-grade gold resources that are not considered National Instrument 43-101 compliant1.

The 10 kilometre long property covers approximately 2,115 hectares and comprises 16 patented mining claims, one mining claim lease, and 109 staked mining claims in Hagey and Conacher Townships of Ontario, on strike with the Delta-1 gold mineralization (see Figure 1). Both the Main Zone and the No. 4 Zone are open at depth and along strike.

The terms of the original agreement are as follows:

| On signing: | $100,000 in cash |

| Anniversary 1: | $150,000 in cash and $100,000 in Delta shares |

| Anniversary 2: | $150,000 in cash and $100,000 in Delta shares |

| Anniversary 3: | $200,000 in cash and $100,000 in Delta shares |

| Anniversary 4: | $300,000 in cash and $200,000 in Delta shares |

| Anniversary 5: | $400,000 in cash and $200,000 in Delta shares |

*All share prices are based on 20 day VWAP and as a function of the amendment announced herein, the minimum price of the shares to be issued by Delta is fixed at $0.075.

Golden Share will retain a 2% Net Smelter Return Royalty (“NSR”). Delta will have the option to buyback a 1.0% NSR at anytime for $3M and will have a right of first refusal on the second 1.0% NSR.

If Delta defines a NI-43-101 resource on the Property after earn-in, Golden Share will be entitled to a bonus of $500,000 for an estimate of 500,000 gold ounces up to 1,000,000 ounces and a bonus of $1,000,000 for an estimate of greater than 1,000,000 gold ounces. There are no work commitments on the property.

With this option, Delta now controls an area of 220 square-kilometres in the central-north portion of the Shebandowan Greenstone Belt, which includes the gold-endowed, crustal-scale Shebandowan structural zone that hosts Delta’s Eureka Gold Zone.

“Delta is building a commanding land position in the Eastern portion of the Shebandowan Greentone Belt. We are very excited about putting all these pieces together in a highly prospective and under explored area where we believe that the potential for multiple deposits exists. We look forward to updating our shareholders and stakeholders with our plans to advance this growing land package,” stated Andre Tessier, President and CEO of Delta Resources Limited.

The agreement is subject to regulatory approval.

Qualified Person

Andre Tessier, P. Eng and P.Geo, and President and CEO of Delta Resources Limited, acted as the Qualified Person for this press release and has reviewed its content.

About Delta Resources Limited

Delta Resources Limited is a Canadian mineral exploration company focused on growing shareholder value through the exploration of two very high-potential gold and base-metal projects in Canada.

DELTA-1 is Delta’s flagship project, where the company is building on a large gold inventory 50 kilometres west of Thunder Bay, Ontario, at surface and adjacent to the Trans-Canada highway. To date, the gold mineralization is defined over a strike length of 2.0 km, from surface to a vertical depth of 250 m. Highlights include drill intercepts such as 5.92 g/t Au over 31 m (incl. 14.8 g/t Au over 11.9 m), and 1.79 g/t Au over 128.5 m. The property covers 220 square kilometres and Delta has identified a 5 km long corridor of intense alteration and deformation at the property, on strike with the gold zone, that has yet to be thoroughly explored.

The DELTA-2 property covers 205 square kilometres in the prolific Chibougamau District of Quebec. The property holds excellent potential for gold-rich polymetallic VMS deposits as well as hydrothermal-gold deposits. Delta targets VMS deposits such as the LeMoine past producer where 0.76 Mt were mined between 1975 and 1983, grading 9.6% Zn, 4.2% Cu, 4.5 g/t Au and 84 g/t Ag.

Note 1: The Band-Ore mineral resource estimates are considered to be ‘historical’ in nature and are not compliant with National Instrument 43-101. Neither Golden Share nor Delta have done sufficient work to classify the historical estimates as current mineral resources or mineral reserves in accordance with NI 43-101, however the data is relevant as it is indicative of potential mineralization on the Property. The Band-Ore Main Zone historical resource comes from the Report on Shebandowan Property Conacher Township Thunder Bay Mining Division Ontario for Band-Ore Resources Ltd., effective date February 15, 2006 with lead author David Gunning, which references the following reports: Report on Property of Band-Ore Gold Mines Ltd., Thunder Bay, Ontario, with lead author J.S. Crosscombe, Mining Engineer, effective date May 15, 1947. The Band-Ore No. 4 Zone historical resource comes from 1982 Diamond Drilling Report and Pre-Evaluation Study on the Band-Ore Option Conacher Township Ontario for Mattagami Lake Exploration Ltd. with lead author Karl J. Huska, December 1982.

ON BEHALF OF THE BOARD OF DELTA RESOURCES LIMITED.

Andre Tessier

President and CEO

www.deltaresources.ca

We seek safe harbor. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX Venture Exchange has not approved nor disapproved of the information contained herein.

For Further Information:

Delta Resources Limited

Andre C. Tessier, CEO and President

Tel: 613-328-1581

atessier@deltaresources.ca

or

Frank Candido, Chairman

Vice-President Corporate Communications

Tel: 514-969-5530

fcandido@deltaresources.ca

Cautionary Note Regarding Forward-Looking Information

Some statements contained in this news release are “forward-looking information” within the meaning of Canadian securities laws. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes” or variations of such words and phrases (including negative or grammatical variations) or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Investors are cautioned that forward-looking information is inherently uncertain and involves risks, assumptions and uncertainties that could cause actual facts to differ materially. There can be no assurance that future developments affecting the Company will be those anticipated by management. The forward-looking information contained in this press release constitutes management’s current estimates, as of the date of this press release, with respect to the matters covered thereby. We expect that these estimates will change as new information is received. While we may elect to update these estimates at any time, we do not undertake to update any estimate at any particular time or in response to any particular event.